There’s a popular phrase used in the investment world, “buy term and invest the difference.” At least since the 1980s it’s captured the prevailing advice about life insurance. In fact, since that time, whole life insurance has sometimes received a bad rap, much of which is undeserved.

There’s a popular phrase used in the investment world, “buy term and invest the difference.” At least since the 1980s it’s captured the prevailing advice about life insurance. In fact, since that time, whole life insurance has sometimes received a bad rap, much of which is undeserved.

More recently, studies have come out that put a new perspective on whole life. It still may not be the go-to investment strategy for many investors, but it deserves consideration.

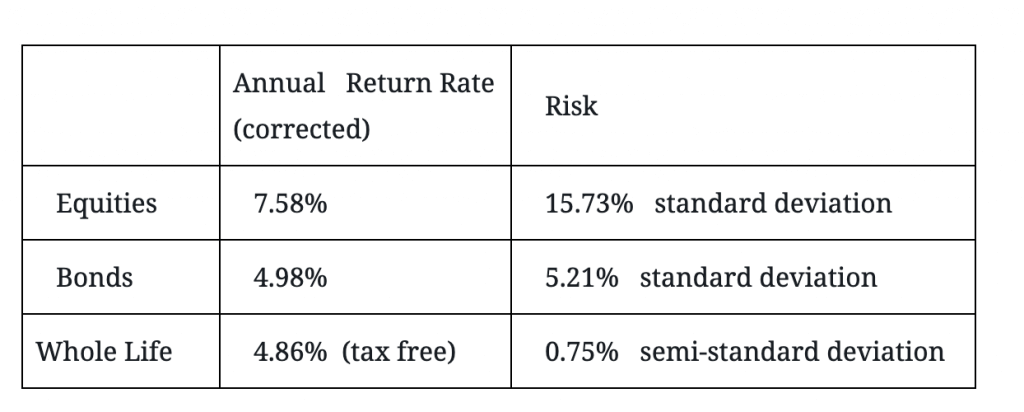

Take the case of a New York Life study that followed equities, fixed-income and whole life assets over the 35 years between 1982 and 2017. The whole life policy not only held its own against the annual return rate on bonds, but delivered potential benefits that neither equities nor bonds could offer.

What follows is only a brief glimpse at the potential for making whole life part of a long-term financial plan. Although the Morningstar Investment Management LLC validated New York Life’s study, the findings in no way serve as a recommendation or endorsement. Furthermore, every investment has risks, and past performance is no guarantee of future risks.

What Is Whole Life Insurance?

In exchange for regular premium payments, whole life insurance provides the beneficiary with a cash payout on the life of the insured individual. But in addition to providing death benefits, whole life serves as a sort of living benefit for the policyholder. The savings component allows a policy’s cash value to accrue. In addition, to the regular premium payments, a policyholder can increase the investment value and build cash value by 1) making additional payments and 2) reinvesting dividends to earn interest.

Furthermore, the policyholder is able to:

- Withdraw funds tax free, up to the total premiums paid.

- Take out a low-interest loan against the equity.

By comparison, term life is designed only to serve as a death benefit protection during a specified period of time. While the premiums are comparatively low, once the term expires, the policy either terminates or is renewed. There is no savings, dividend or cash-value component beyond the death benefit payment.

How Does Whole Life Compare with Investment-Grade Assets?

The findings in the study, “Can an Investor Reduce their Overall Portfolio Risk by Allocating from Fixed Income to a Whole Life Insurance Policy?”, make a fairly interesting case for allocating whole life as a replacement for some or all fixed-income assets in a long-term portfolio strategy. Here’s how New York Life structured its test:

- In 1982, the policyholder was a 35-year-old male who would hold the whole life policy for 35 years and reinvest dividends until it was time to take the full cash surrender value

- The equity component was based on historical returns and risk data on a Large Blend US Fund

- The bonds were based on historical returns and risk data on an Intermediate US Bond Fund

- Both equity and bond returns were corrected for fees and taxes

- This comparison works only when the policyholder is young enough and retains the policy long enough to benefit from the power of compounding the reinvested dividends for 35 years

The results:

The benefits:

- While annual return rates between bonds and whole life are fairly comparable, the risk with the insurance policy is lower, making the risk-reward proposition for whole life more attractive

- In addition to the benefits for the policyholder, death benefits are protected and guaranteed as long as premium payments are made and the insurance company remains solvent

- Whole life may also help reduce volatility in a portfolio, and if the policy is insured by a top-rated company, an AA+ rating could help reduce the credit risk across the entire portfolio

Are Financial Advisors Ready to Take a Second Look at Whole Life?

Given the risk-reward returns, perhaps. And some financial advisors may appreciate the importance of liquidity afforded with a whole life policy.

Furthermore, affluent investors and high net worth individuals who have maxed out contributions to their 401(k)s, IRAs, Roths and other tax-deferred plans may want another investment with the added benefit of insurance.

Discuss the pros and cons of allocating a whole life policy to your portfolio as a possible replacement for some or all of your fixed-income bonds. But make sure that your advisor is knowledgeable and well versed on the best ways to structure a whole life policy and integrate it into your comprehensive financial plan. If your advisor is unsure and doesn’t work with an insurance specialist, ask about bringing in an independent advisory firm that specializes in turnkey insurance investment services.

In summation, the critical step for you as an investor is to weigh all your options. Determine if a less volatile, long-term strategy makes sense at this time in your life. Do you have enough income for the higher premiums, and do you need insurance to protect your loved ones? If you are young enough to benefit from the long-term interest compounding and want the insurance component, it’s good to know that there may be a sensible way to make whole life part of your overall financial plan.