What are the chances you will become disabled?

Whatever your answer to that question, you’ll probably err on the side of optimism. After all, that’s human nature. People are likely to underestimate the odds of something bad happening to them. When researchers asked individuals to estimate their chances of getting cancer or being in an automobile accident, most people considered their chances were lower than that of others.[i] That’s like saying “all our children are above average.” It’s impossible.

Thinking “It won’t happen to me,” is commonly known as the optimism bias. Because it means individuals are less likely to prepare for risks and be protected if life takes a wrong turn, and it can have negative consequences.

Given that you’re reading this article, however, you are already thinking ahead and want to have a realistic perspective on the risks of becoming disabled. Given that, let’s start with some statistics.

Over ten percent of working-age people (18-64) in the United States had disabilities in 2015 — that’s about one in ten people.[ii] What’s concerning about that statistic is how a disability affects someone’s ability to work. While 76 percent of 18-64 year-olds without disabilities work, only 34.9 percent of those the same age with disabilities are employed. So if you have a disability, you are less than half as likely to be working. That can be costly.

If you have an optimism bias along with a dose of skepticism, you’re likely thinking, “These statistics do not necessarily apply to me. I’m in a different demographic. Doctors are less likely to become disabled.” That’s true, but the difference is negligible. The percentage of people with disabilities who work in healthcare is 8.1 percent, slightly below the average.

What you’re really concerned about, however, is your own risk of becoming disabled. To find out what it is, you can assess your Personal Disability Quotient (PDQ), the chances of you not being able to work for a short or extended period. Simply use the PDQ tool from the Council for Disability Awareness. You plug in your sex, age, the nature of your work, tobacco usage and a couple of other tidbits, and it will tell you the likelihood you will become disabled and for how long.

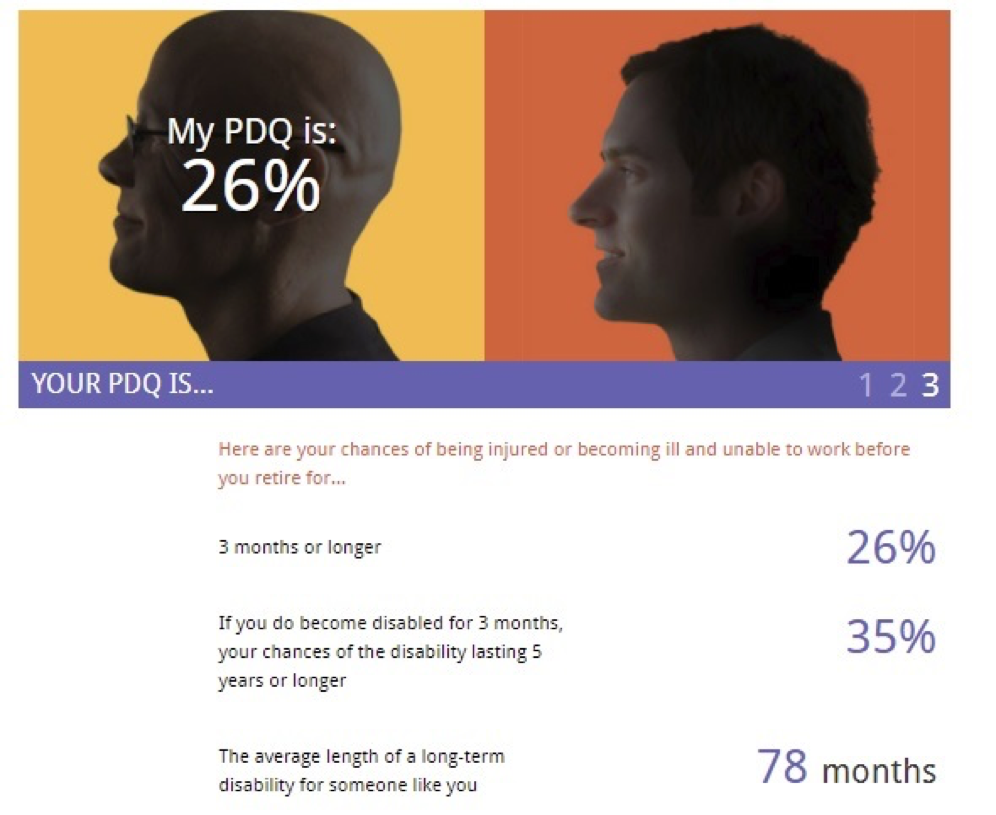

Here are a couple of scenarios. Shirley has finished her residency and is starting a job as a physician at the age of 30 with a salary of $200,000. She’s 5 foot 7 inches, weighs 130 pounds, does not use tobacco, lives a healthy lifestyle and is not undergoing treatment for any chronic illnesses. When she fills out the data required for the PDQ assessment, it provides the information below.

Source: Council for Disability Awareness

She can also discover her Earnable Income Quotient (EIQ), which is the amount of money she is likely to earn over her career as long as she does not become disabled. She’s conservatively anticipating three percent increases each year and does not plan to retire until she is 65. Her EIQ is a startling $12,092,416.

The second scenario is Sam, who is 40 years old and makes $349,000. He’s 5 feet 11 inches, 200 pounds and does not smoke, but spends too much time on the job, so his lifestyle is not as healthy as it could be. He also has a chronic backache and plans to retire at 65. His chances of becoming disabled and unable to work are higher than Shirley’s (37 percent). There’s a 40 percent chance that his inability to work will last five years or more and the average length of disability for someone like him is 85 months. Interestingly, Sam’s EIQ is $12,724,283, similar to Shirley’s. His higher salary is offset by having fewer years ahead of him.

The important finding from this exercise is that even though your future earning potential is intangible — you do not have the money yet — the amount at risk is likely more than the value of your home or automobile. However, while most doctors would not question the value of obtaining home or auto insurance, they may fail to consider disability insurance. Thus, it pays to learn more about your PDQ and EIQ. These calculations could change the way you think and help you take the steps necessary to protect your future income and lifestyle.

[i] Frank P. McKenna — It won’t happen to me: Unrealistic optimism or illusion of control?

[ii] Rehabilitation Research and Training Center on Disability Statistics and Demographics — 2016 Disability Statistics Annual Report